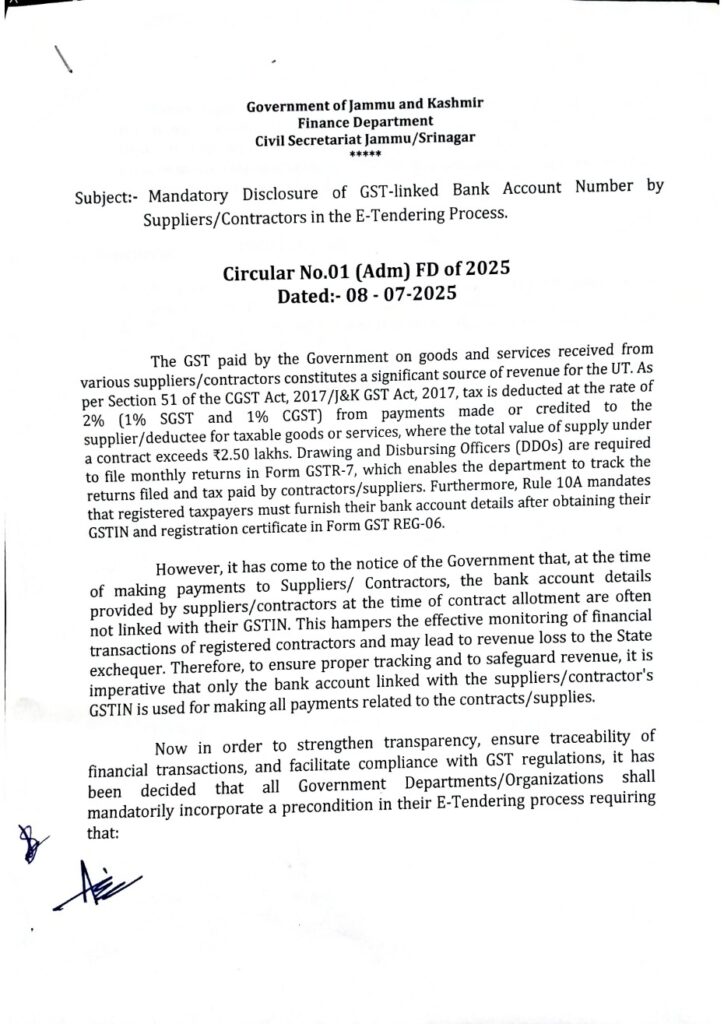

In a significant step toward improving financial transparency and ensuring strict GST compliance, the Government of Jammu and Kashmir has mandated all suppliers and contractors participating in the e-tendering process to disclose their GST-linked bank account details at the time of bid submission. This reform aims to streamline government procurement, prevent tax evasion, and strengthen traceability of financial transactions.

GST Compliance Now Essential in E-Tendering

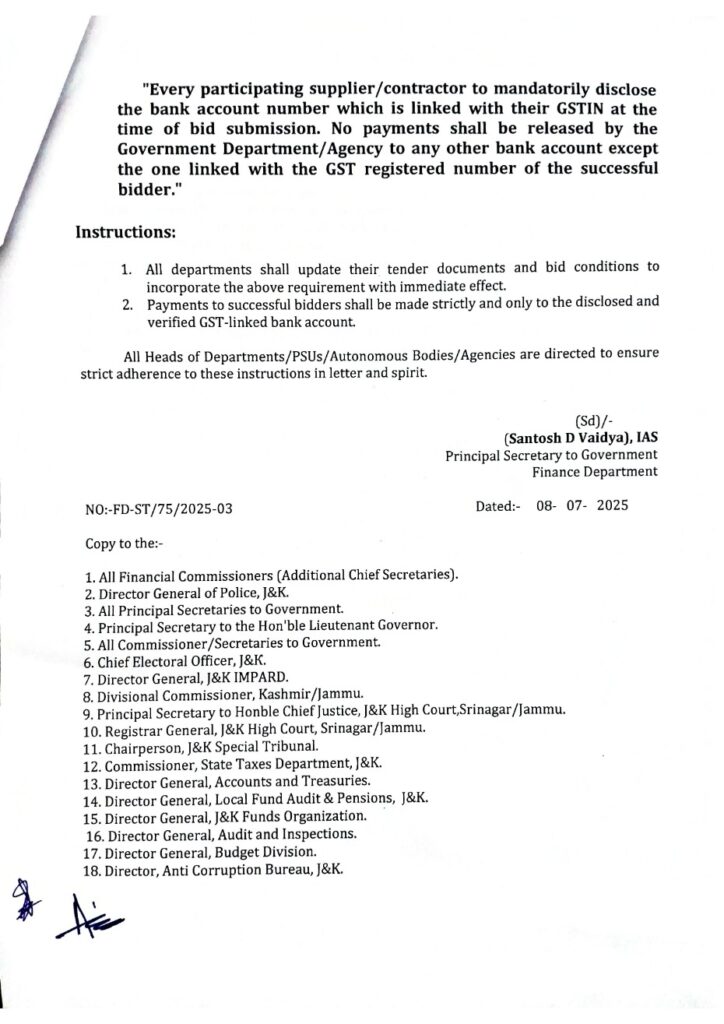

As per a recent government circular, all departments and public sector organizations in J&K must revise their tendering procedures immediately. The new rule stipulates that payments to successful bidders will only be processed to bank accounts associated with their GSTIN (Goods and Services Tax Identification Number). This mandatory disclosure is now a precondition for all government e-tenders.

What Does the New Rule Require?

To align with this policy, all bidders in government tenders must:

- Disclose the bank account number linked with their GSTIN during bid submission.

- Ensure that the declared account is valid, active, and verifiable.

- Understand that no alternative bank account will be accepted for payment, regardless of circumstances.

This initiative enforces traceability of funds and prevents diversion of payments to unregistered or unauthorized accounts.

Why the New Rule Matters: Benefits and Objectives

The move serves multiple goals crucial to efficient governance:

1. Strengthening Financial Transparency

By requiring GST-linked bank account details, the government can track every rupee disbursed to suppliers and contractors. This accountability discourages manipulation and misuse of funds.

2. Ensuring GST Compliance

With this rule in place, vendors cannot use non-GST-compliant channels to receive funds. It eliminates the risk of tax evasion and ensures that vendors maintain proper registration and documentation.

3. Preventing Revenue Leakage

Payment traceability helps curb fake billing and ghost vendor practices, a common concern in public procurement. Ensuring that payments only go to verified GST accounts minimizes revenue loss for the government.

Mandatory Updates for All Departments and Agencies

All Government Departments, Public Sector Undertakings (PSUs), Autonomous Bodies, and other related agencies have been instructed to implement this directive without delay.

Instructions to Departments Include:

- Immediate Update of Tender Documents

All tender notices, bid documents, and procurement terms must now include the mandatory GST-linked bank account disclosure clause. - Strict Payment Guidelines

Payments will be made only to the verified GST-associated account of the successful bidder. No exceptions or alternate payment routes are allowed. - Departmental Oversight and Compliance

Heads of Departments (HoDs) and procurement officers are accountable for enforcement. Non-compliance may be subject to scrutiny and penalties.

Impact on Suppliers and Contractors

1. Mandatory Bank Account Verification

Suppliers must ensure that their GSTIN is accurately linked with a valid bank account. Mismatches or delays in updating this linkage may lead to disqualification or payment delays.

2. Increased Documentation Requirements

Contractors must now maintain up-to-date GST registration documents, bank certificates, and account verification letters to comply with the revised bid terms.

3. Competitive Bidding with Transparency

These new norms create a level playing field, where only tax-compliant, financially transparent businesses can compete for government contracts.

A Step Forward for Digital Governance and Procurement Reform

The J&K Government’s move is aligned with India’s broader vision of Digital India and transparent governance. By integrating GST verification into public procurement, it not only enhances fiscal responsibility but also promotes clean and compliant business practices.

This step builds upon past efforts like:

- e-Tendering platforms to eliminate manual processes

- Mandatory PAN and GST registration for vendors

- e-Payment systems with real-time tracking

Such integrations make government procurement more efficient, accountable, and aligned with national tax systems.

To continue doing business with government entities in Jammu and Kashmir, suppliers and contractors must now adapt to this strict GST-integrated procurement process. Transparency, accountability, and compliance are no longer negotiable—they are standard operating requirements.